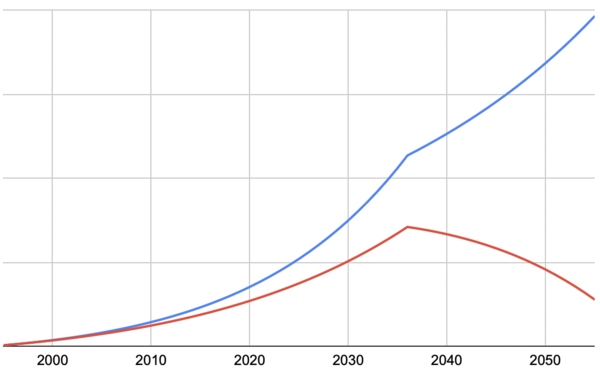

Last week, I wrote about the first lesson that made a big difference in how I thought about personal finance. Namely, that savings rate is a big driver to outcomes, and that it is very much in your control. Along with that is the binary outcome of whether your savings grow or shrink in retirement and the divergent net worth results you will have as a result of that.

The next big lesson I got was from reading Ramit Sethi’s I Will Teach You to be Rich [amazon affiliate link]. By the time I had read this (I was 39), my finances were pretty much in order, and most of the book was more of a reinforcement that I was doing the right thing. It’s also a very entertaining read.

However, I did get one thing—a change in mindset to focussing on income over expenses to increase savings.

Look at the Net Worth spreadsheet. If you set it to a fairly high earner, say 100k to start and a savings rate of 20%, then at 39, they need to save around 28k.

This is aggressive. It would be hard to do much more. If you pay 30% for taxes and 25% for rent, you only have 25% left for everything else. It’s hard to imagine that you could find another 10,000 in savings.

But, finding another $10,000 in income is really not that hard for a programmer.

The book (and his site and blog) give many examples, but simply asking for a raise is probably the simplest and most likely to work. If you get into a habit of renegotiating every year, the combined effect compounds.

His other suggestion is side income. If you are a programmer, there are many ways you could do this. I tried many things over the years. In order of income success:

- Advisory consulting on software projects

- Programming side-gigs

- An Excel add-in

- Tutoring/Coaching programmers (I mostly do this for free, but I charged people that could afford it or where their company paid)

- Writing a book

- Writing for Smashing

- Add-ins for niche software (including for a future employer)

- iOS Apps (they are all free now, but early App Store was more amenable to paid apps)

- iOS Skillshare classes

Over my career, I made significant side income directly from this, which I mostly saved. In addition, many of these things directly altered the course of my career and led to better jobs.

For example, writing apps led to getting a book deal and becoming an iOS programmer with at least some credentials. That helped me get consulting gigs when I did it full-time (or on the side) and was a factor in getting hired by Trello (along with, possibly, the add-ins I made for FogBugz and CityDesk).